Cutting and decommissioning specialisms

WELL DECOMMISSIONING

We develop innovative, safe and dependable onshore and offshore services that create commercial advantages and carbon efficiencies for our customers. Combining service and technology allowing the rigless abandonment, severance and recovery of CAT1 and CAT2 surface and subsea wells which minimises/optimises rig and vessel time. We can operate effectively from platforms, rigs, barges and vessels, ensuring the most cost and environmentally efficient delivery of projects.

ASSET LIFE EXTENSION

We deliver solutions for a wide range of asset types to extend usable lifespan by providing repair and upgrade services to existing assets. Our innovative solutions for recovering old conductors utilise bespoke tooling and fast-track engineering to give customers confidence and reassurance with ageing assets. We provide fatigue analysis which aids asset repair and can also recommend and engineer solutions for upgrade. Our time and cost-effective slot recovery package include rigless recovery of conductors and driving of replacement conductors.

ENGINEERING ANALYSIS AND TECHNOLOGY DEVELOPMENT

Through customer engagement, operational experience and engineering expertise, we apply our industry-leading domain knowledge to successfully bring new, efficiency-enhancing, technology to market. We have pioneered technology through globally recognised brands including SWAT™, WellRaizer® and SABRE™ which are used to provide efficient and alternative approaches to well abandonment projects. We also apply technology to improve reliability through well sealing, laser cutting and cut verification.

MANUFACTURING AND FABRICATION

Our engineered manufacturing and fabrication services provide an integrated design, analysis, manufacture and fabrication resource to all markets. Eliminating the need for independent design and manufacture increases project efficiency and reduces time and cost. Our in-house raw material stock, machines and engineering expertise allow us the flexibility to rapidly design equipment manufactured to specific intellectual property to suit customers’ needs including an API-6A certified range of pressure control related components and packages.

WELLS - DRILLING RISER SERVICES

We evaluate, design, manage and install complete riser and tensioning systems and solutions to allow safe and environmentally friendly control and capture of pressurised drilling fluids for shallow water, subsea or surface wells. Our highly responsive and flexible service is underpinned by fast in-house engineering, manufacturing and fabrication, and a large inventory for rapid call off. Our project delivery and after-market service make us a centre of excellence for drilling risers.

CONDUCTOR AND PILE INSTALLATION

Our high-tech hammer equipment and multi-skilled engineers enable us to deliver piling services for all manner of surface and subsea construction projects. In conjunction with geotechnical data and an extensive archive of global drive logs, extended technical assurance is provided in the form of conductor driveability assessments. The feasibility of conductor driving is theoretically evaluated in accordance with the required setting depth helping customers to understand driving behaviour and to mitigate the risks of early refusal well in advance of project execution.

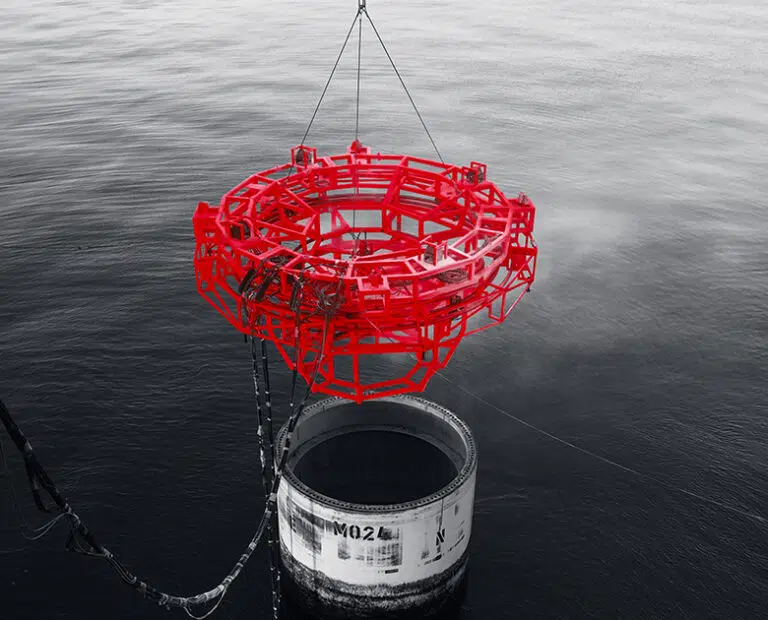

OFFSHORE WIND FOUNDATION CLEANING

We provide custom-made offshore wind foundation cleaning tools to enable reliable installation of grouted transition-piece connections. This includes specialist systems that provide ultra-high-pressure water jets customisable for all specific cleaning requirements. Our approach provides significant time saving, increased safety and reduced debris compared to alternative diver solutions.

DRILLING AND DECOMMISSIONING SERVICES - REQUEST MORE INFORMATION

Acteon’s expertise in drilling and decommissioning spans decades and covers the full lifecycle of a project from the acquisition of subsea information and data, to bespoke drilling packages to onshore disposal and recycling.